We’ve been warned of dark times ahead for Brisbane’s apartment market, but there’s more than a glimmer of hope in the distance.

Brisbane real estate agents increasingly refer to Brisbane’s apartment market as a “two-speed” market in which demand for ultra-luxury, $2 million-plus apartments is rapidly surpassing supply and apartments at the other end of the price spectrum are looking at a price decline.

Buyer and investor confidence in high-end apartments is at an all-time high in Brisbane, a sharp contrast to the buying climate just two years ago when “… trying to sell an apartment above $2 million was very difficult,” says Grace and Keenan’s Mike Ower.

However, “over the past 18 months that’s changed significantly,” as apartments at the high end of the price spectrum continue to increase in median price.

The difference between the high-end and the lower end of the market couldn’t be more pronounced.

While more affordably priced units in many high-density areas across Brisbane have been declining in price, luxury apartments in the CBD, West End and New Farm have been receiving more attention than ever.

Downsizers represent a significant percentage of the buyers in the $2 million-plus market — which is to be expected as older couples swap large inner-city homes for luxury inner-city apartments — but don’t overlook the diversification taking place among the high-end apartment market.

Originally the local pack appeared down below the organic listings and showed 7 businesses:

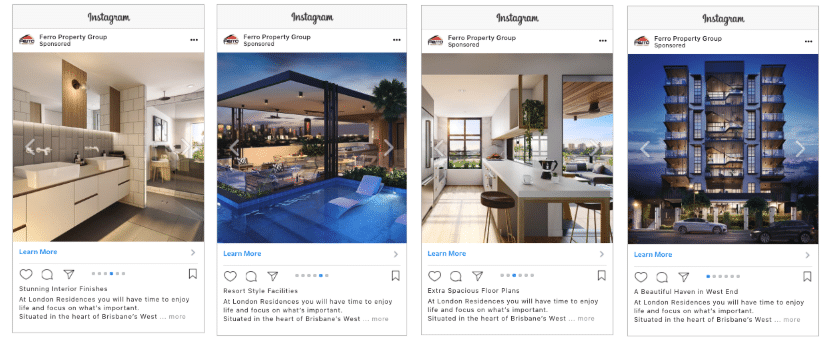

London Residences’ luxurious, home-sized residences and enviable location have made it one of the most successful high-end boutique property developments in Brisbane.

London Residences by Ferro Group has been successfully marketed to owner-occupiers, but the target market here isn’t only downsizers looking for a luxury residence ideally placed in Brisbane’s cultural hub of West End, but also families.

As with the new West End development, West Village, London Residences has seen a lot of interest from families of all ages, particularly families with both parents working in the CBD.

The trend we’re seeing isn’t only about the convenience inner-city lifestyles provide but also the demand for lifestyle.

As Megan Barron, sales, marketing and property management director at West Village said recently, “These are not buyers who want to live in an apartment and eat out every night – they want a gourmet kitchen like you’d get in a house so they can cook their own meals. They don’t want to live in vanilla apartments.”

The release of these three and four-bedroom home-sized apartments reflect the demand for “larger, custom-designed three and four-bedroom apartments in Brisbane”, which Marco Ferro says is “largely untapped and very strong.”

While much is made of investors — especially foreign investors — snapping up apartments Australia-wide, according to Mr Ferro and Ms Barron, it’s owner-occupiers, not investors, focusing on larger apartments in the inner-city and surrounding suburbs.

Bambrick Media’s Instagram ads were instrumental in promoting London Residences in West End.

Along with London Residences, this trend was also evident with Ferro’s Edgebrook Apartments at Lutwyche, where 80% of all units were three bedroom apartments sold to owner-occupiers.

Brisbane’s apartment market often seems like a ‘boom or bust’ scenario. But with increased demand for high-end apartments, Queensland’s stable economic outlook, a significant decline in apartment development approvals and widespread expectations of the market stabilising towards the year’s end, the outlook certainly isn’t as bleak as some would have you believe.

Bambrick Media is a direct response digital marketing agency in Brisbane. We’ve helped many property developers generate interest in off-plan developments across Brisbane and Southeast Queensland through Google Ads and Social Media campaigns, and include CBRE, Ferro Group, Lacey Group and Effinity among our valued clients in the local property development sector.

Struggling to get enough leads for your property development? Contact us here.

Image Credits — Bambrick Media, Ferro Group, Michael on Unsplash